Japan’s Economic Crisis: From Post-War Miracle to Demographic Squeeze (1945–2026) – CNA

Japan’s Economic Crisis: From Post-War Miracle to Demographic Squeeze (1945–2026) – CNA

Japan’s Economic Crisis: From Post-War Miracle to Demographic Squeeze (1945–2026)

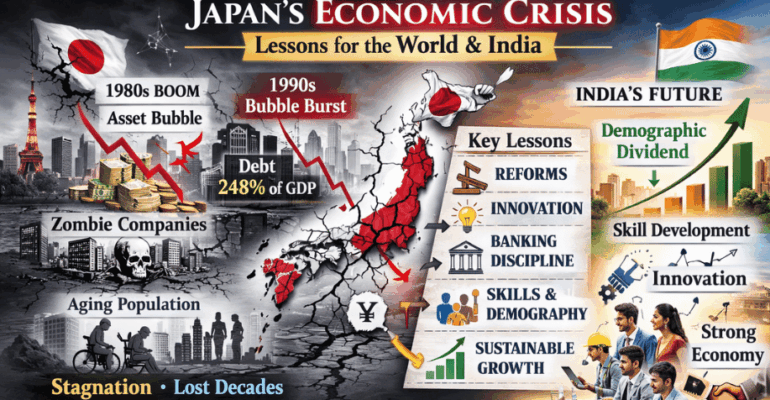

When students discuss Japan’s crisis, they often describe it as an economic collapse. That framing is inaccurate. Japan is not collapsing in the way emerging economies collapse. Japan is experiencing a prolonged structural compression driven by three interlinked forces: an asset-bubble hangover, policy-induced stagnation, and an unprecedented demographic inversion.

To understand the present, we must begin with the height from which Japan fell.

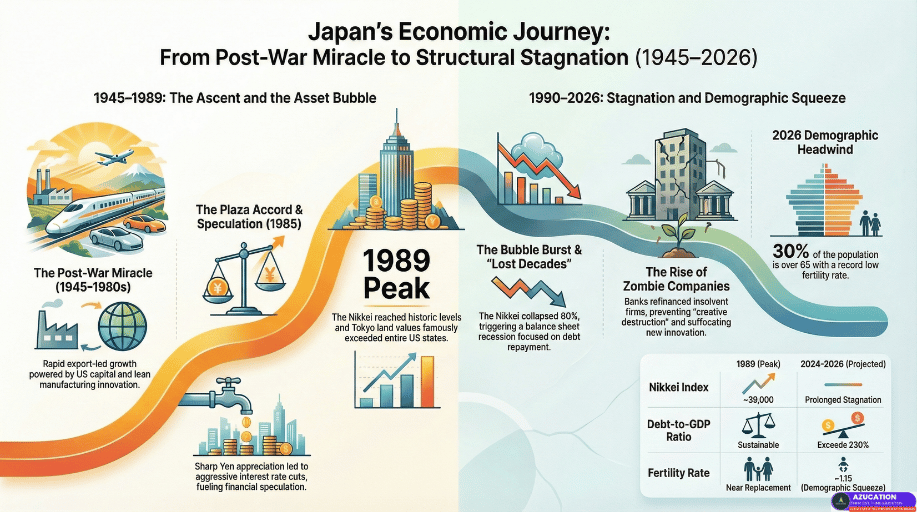

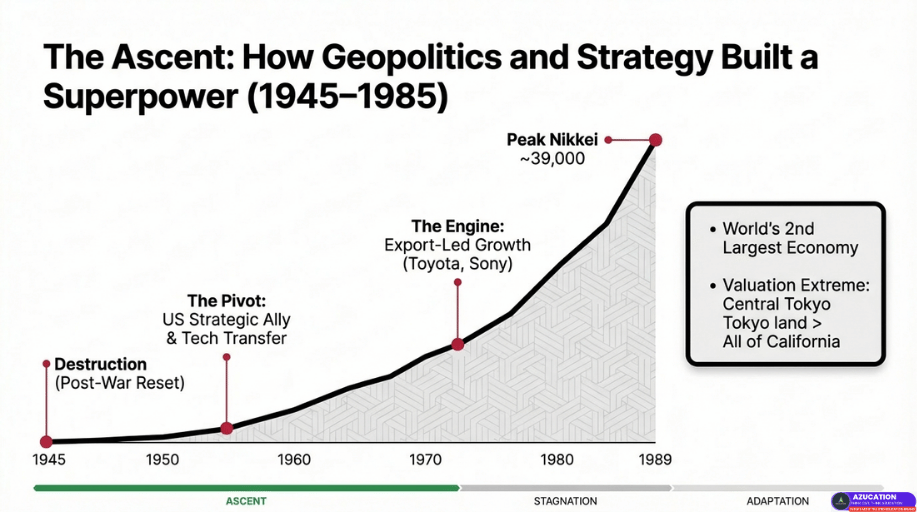

The Post-War Miracle: How Japan Became an Economic Superpower

In 1945, Japan was physically and economically destroyed. Two atomic bombs, mass bombing of major cities, industrial collapse, food shortages — the country’s productive capacity was shattered.

However, geopolitics reshaped its destiny.

During the early Cold War, the United States feared communist expansion across Asia. Instead of punishing Japan economically, the US rebuilt it.

American capital entered Japanese industry. Technology blueprints were shared. Japan adopted an export-led growth model. Firms like Toyota perfected lean manufacturing. Sony innovated in electronics. Toshiba became dominant in memory chips.

By the late 1980s, Japan was the world’s second-largest economy. The Nikkei index surged from around 6,000 in the early 1980s to nearly 39,000 by 1989. Real estate prices soared. Japan appeared unstoppable.

That confidence created fragility.

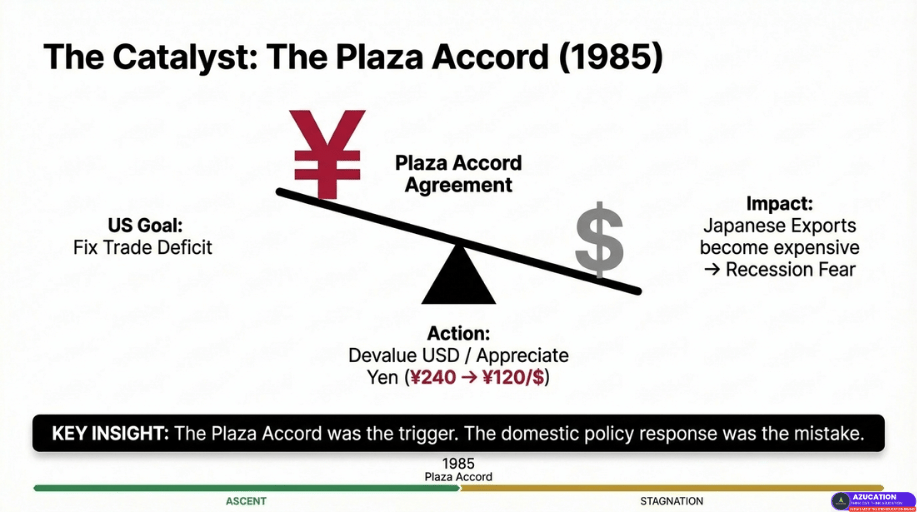

The Plaza Accord: Currency Shock and the Seed of Instability

In 1985, the United States faced a growing trade deficit. The Plaza Accord was signed to coordinate currency adjustments.

The yen appreciated sharply — from roughly ¥240 per dollar to near ¥120.

To prevent recession, the Bank of Japan slashed interest rates aggressively.

The mistake was not cheap credit. The mistake was its misallocation.

Instead of investing in productivity, corporations and individuals diverted funds into financial speculation. Stock prices surged. Real estate detached from reality. The economy entered bubble territory.

The Bubble Burst and the “Balance Sheet Recession”

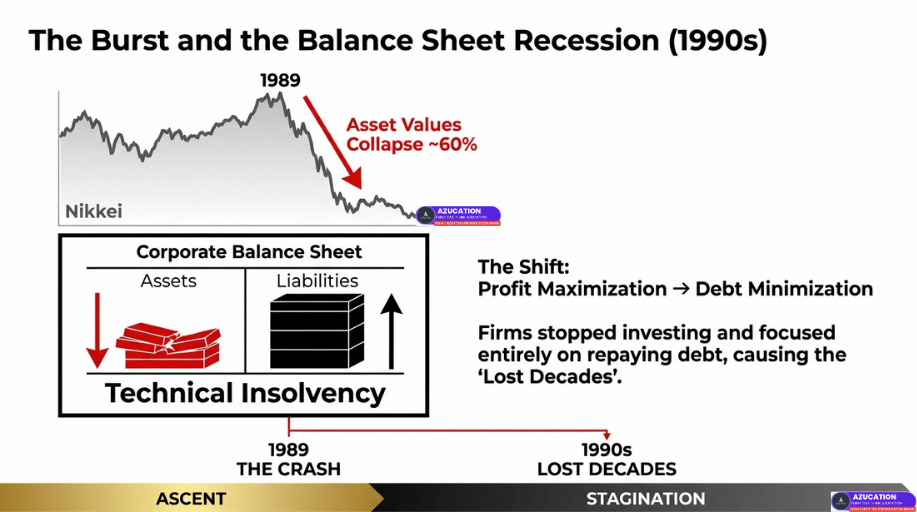

In 1989, the Bank of Japan raised interest rates. The bubble burst.

The Nikkei collapsed nearly 60%. Real estate prices fell for over a decade. Companies became technically insolvent.

Investment froze. Consumption weakened. Growth stalled.

This period became known as the “Lost Decades.” Wages stagnated. Inflation disappeared. Japan entered persistent deflation.

The Zombie Company Paradox

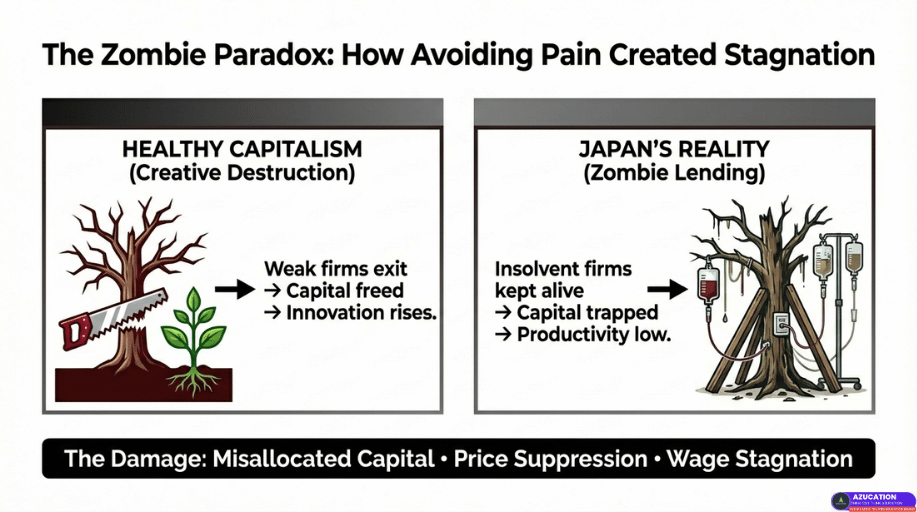

Instead of allowing creative destruction, banks refinanced struggling firms.

These “zombie companies” survived but did not grow. They misallocated capital, suppressed profits, blocked innovation, and slowed wage growth.

The cost of avoiding short-term pain became long-term stagnation.

Demographic Collapse: The Structural Squeeze of the 2020s

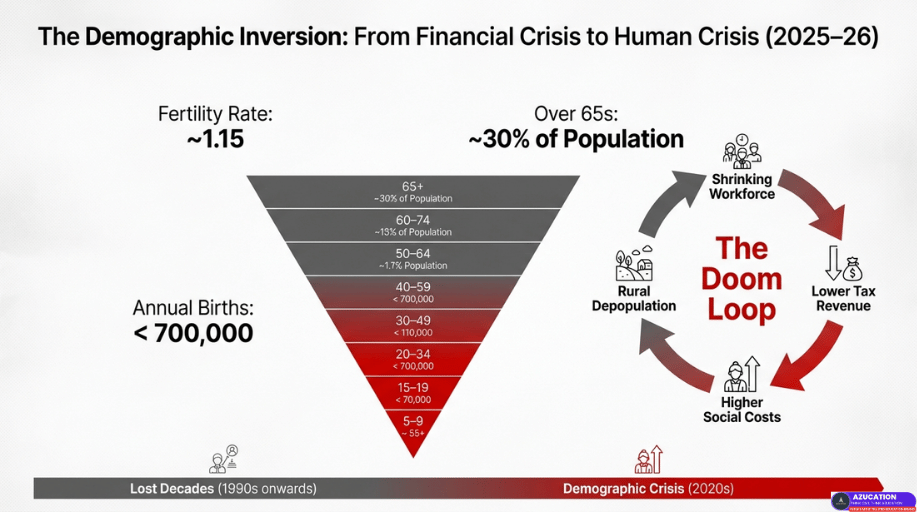

Japan’s fertility rate has fallen to around 1.15. Nearly 30% of the population is above 65.

Labor shortages, school closures, shrinking towns, and business succession failures define modern Japan.

Japan is facing a demographic headwind that continuously pushes growth downward unless offset by massive productivity gains.

The Debt Question: Sustainability Under Strain

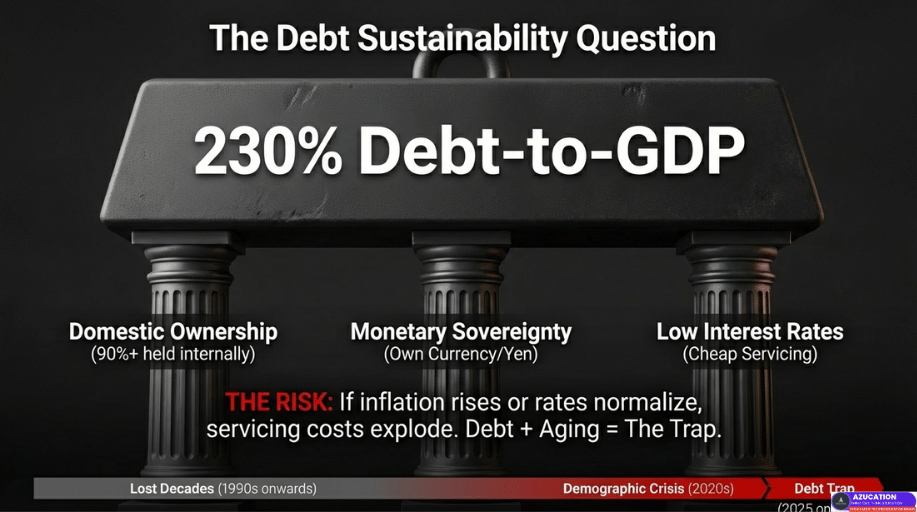

Japan’s public debt exceeds 230% of GDP.

While domestically financed, rising interest rates and aging costs create long-term sustainability concerns.

Debt alone is not a crisis. Debt combined with aging and slow growth is the risk.

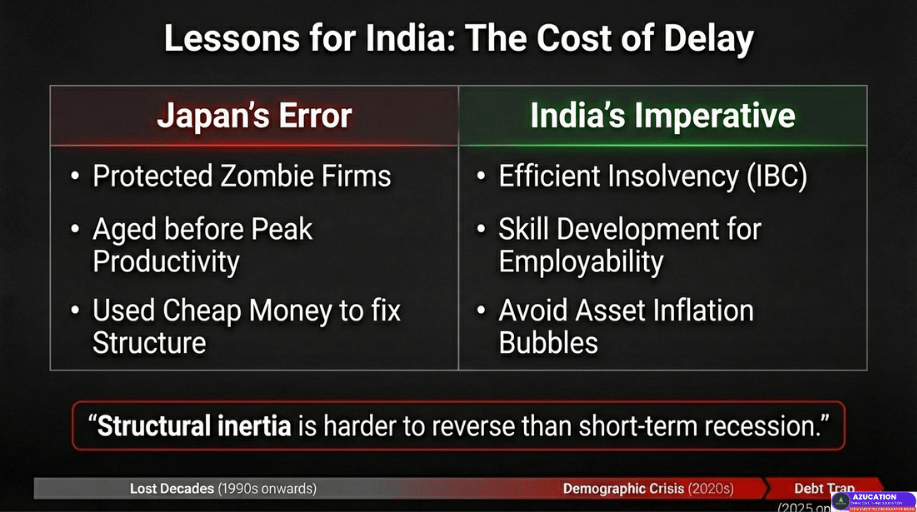

Lessons for India: What Must Be Avoided

India must learn:

• Capital allocation discipline is critical.

• Demographic dividend is temporary.

• Macroeconomic sequencing matters.

• Productivity must rise before demographic momentum slows.

Final Analytical Conclusion

Japan is not collapsing. It remains technologically advanced and globally integrated.

But it is experiencing structural compression created by past financial excess and demographic inversion.

The real danger in economics is rarely explosion. It is stagnation.

5 High-Impact IIM-Level Personal Interview Questions

The Plaza Accord was a trigger, not the structural cause. It accelerated existing vulnerabilities in Japan’s financial system.

The sharp appreciation of the yen reduced export competitiveness. To cushion the shock, the Bank of Japan aggressively lowered interest rates. The policy itself wasn’t flawed — the misallocation of credit was.

Instead of funding innovation or productivity upgrades, cheap liquidity fueled speculative investments in equities and real estate. Asset prices detached from fundamentals, creating one of the largest bubbles in modern history.

When tightening began in 1989, the bubble burst, exposing weak corporate balance sheets and excessive leverage.

Zombie companies are insolvent firms that survive due to continuous refinancing instead of bankruptcy.

After the asset bubble burst, banks rolled over bad loans to avoid recognizing losses. This avoided immediate panic but created systemic stagnation.

- Capital misallocation — funds remained locked in low-productivity firms.

- Industry margin suppression — weak firms competed aggressively to survive.

- Labor immobility — workers remained stuck in declining sectors.

Research shows that such “evergreening” of loans suppresses productivity growth economy-wide.

Japan’s debt structure differs significantly from crisis-hit nations like Greece.

- Majority of debt is domestically held.

- Debt is denominated in yen — Japan controls its currency.

- Low interest rates kept servicing costs manageable for decades.

However, risks remain. Aging increases fiscal burden. Rising rates could strain sustainability.

Full reversal is unlikely. Fertility has remained far below replacement for decades.

Policy responses include:

- Increasing female labor participation

- Extending retirement age

- Automation and robotics

- Selective immigration

- Raising productivity per worker

Japan cannot grow through population expansion anymore — it must grow through productivity.

Japan offers three structural lessons for India:

- Capital Discipline: Avoid protecting inefficient firms; ensure IBC efficiency.

- Demographic Urgency: Skill development must match population advantage.

- Policy Sequencing: Liquidity expansion must align with productivity reform.

Stagnation builds gradually when structural weaknesses are ignored.

Download Printable PDF Version

📥 Download CNA PDFEnd Note — From Amiya

Japan is not a story of failure. It is a story of delayed correction.

Stagnation is not caused by one mistake. It is caused by many small delays.

Will we correct early, or will we correct late?

– AzuCATion

Address

AzuCATion, above Canara Bank

near Plaza Cinema, Ranchi,

Jharkhand 834001

Download App Now

© Azucation. All rights reserved.

- Cuboid & Cube Painting Visualizer (Free Resource)

- |x| + y = 10 & x + |y| = 6

- √(x²) = |x| — Radical Distance Trick

- 2^{sin x} + 2^{cos x} — Sharp Lower Bound

- About

- Account

- Algebra Question Bank for CAT | Topic-Wise Practice with Solutions

- All Courses

- Angle Bisectors Between Parallels — Meet at 90°

- Avg of First n Terms ⇒ Sₙ and tₙ — One-Page Cheat Code

- B School Tracker Dummy

- B Schools Expected Calls & PI Predictor : MBA/PG 2026-28

- BAT-1 Likert Scale Behavioural Assessment for MBA Interviews

- BAT-2 Situational Judgment Test (SJT) for MBA Interviews

- BAT-3 Forced Choice Behavioural Test for MBA Interviews

- BAT-4: Short Answer Behavioural Test

- Become A Teacher

- Best CLAT Coaching in Ranchi

- Best MBA Application Deadlines 2026-28 (CAT, XAT, NMAT, SNAP) | AzuCATion CAT Coaching

- Best Practice Sets of DI LR for CAT and XAT

- Best UPSC CSAT Coaching

- CAT 2024 Freedom Sale

- CAT 2025 Raw Score → Scaled Score → Percentile | AzuCATion Predictor

- CAT 2025 Slot 1 RC Sources (Verified) — 3 out of 4 from Aeon | AzuCATion

- CAT 2025- New Batch

- CAT Best Coaching in India for CAT 2025 | AzuCATion

- CAT Best Coaching in Jharkhand | AzuCATion CAT 2026 Prep

- CAT Best Coaching in Ranchi for CAT 2025 | AzuCATion

- CAT Coaching

- CAT Coaching In Jharkhand

- CAT Geometry — When BD = AD = AC & angle DAC = 96°

- CAT Quant Cheat Codes – Amiya Sir

- CAT Question Paper

- CAT Quant 2025 Slot 1

- CAT 2025 Slot1 Quant: In a circle with center C and radius 6√2

- CAT 2025 Slot1 Quant: The (x,y) coordinates of vertices P,Q and R of a parallelogram

- CAT 2025 Slot1 Quant: The ratio of the number of students in the morning shift and afternoon shift

- CAT 2025 Slot1 Quant: A cafeteria offers 5 types of sandwiches.

- CAT 2025 Slot1 Quant: A container holds 200 litres of a solution of acid and water,

- CAT 2025 Slot1 Quant: A shopkeeper offers a discount of 22% on the marked price

- CAT 2025 Slot1 Quant: Arun, Varun and Tarun, if working alone, can complete a task in 24, 21, and 15 days

- CAT 2025 Slot1 Quant: At a certain simple rate of interest, a given sum amounts to Rs 13920 in 3 years

- CAT 2025 Slot1 Quant: For any natural number k , let ak=3k . The smallest natural number m

- CAT 2025 Slot1 Quant: If the length of a side of a rhombus is 36 cm and the area of the rhombus is 396 sq. cm

- CAT 2025 Slot1 Quant: In a 3-digit number N, the digits are non-zero and distinct

- CAT 2025 Slot1 Quant: In a class, there were more than 10 boys and a certain number of girls

- CAT 2025 Slot1 Quant: In the set of consecutive odd numbers

- CAT 2025 Slot1 Quant: Kamala divided her investment of Rs 100000 between stocks, bonds, and gold

- CAT 2025 Slot1 Quant: Let 3≤x≤6 and [x2]=[x]2 , where [x] is the greatest integer

- CAT 2025 Slot1 Quant: Log The number of distinct integers

- CAT 2025 Slot1 Quant: Solving Systems of Linear Equations with 3 Variables

- CAT 2025 Slot1 Quant: Stocks A, B and C are priced at rupees 120, 90 and 150 per share

- CAT 2025 Slot1 Quant: The number of distinct pairs of integers

- CAT 2025 Slot1 Quant: The number of non-negative integer values of k

- CAT 2025 Slot1 Quant:Shruti travels a distance of 224 km in four parts

- CAT Quant 2025 Slot 1

- CAT Reading Comprehension (RC) Question Bank – Topic-wise RC Sets with Answers

- CAT Score vs Percentile (2023–2025)

- Cheat Codes: x + 1/x, x – 1/x & Their Powers

- CMAT 2024

- Compare a^b and b^a

- Contact

- Counting Solutions of 1/m ± 1/n = 1/k (TNF Trick)

- Course Checkout

- Courses

- Curated News Analysis (CNA) Index | MBA WAT GD PI | AzuCATion

- Cyclic Quadrilateral — Shorter Diagonal

- EMI Made Easy — Formula, Intuition & Quick Checks

- Equidistant Points on Hypotenuse – Sum Trick

- FGP Trick: Fibonacci over Powers

- Flipping Signs in 1+3+5+…+99

- Forgot Password

- Free Content

- GD PI WAT preparation for MBA in Jharkhand

- Geometric Sequence with Middle Term 720 – Least b

- Geometry and Mensuration Question Bank for CAT, XAT, and Other MBA Exams

- GPs with single-digit terms

- Greatest M so that M+1213 and M+3773 are perfect squares

- Happy Family CAT 2022

- Happy Family CAT 2023

- Happy Family CAT 2024

- Happy Family SSC CGL

- Happy MBA Family

- IIM Ahmedabad MBA (PGP) Selection Criteria 2026–28 | CAT 2025

- IIM Ahmedabad MBA-FABM Selection Criteria 2026–28 | CAT 2025

- Informative

- Instructor

- Instructors

- IPM IPMAT BBA Coaching

- Log Puzzle: (log₂x · log₃x)/(log₂x + log₃x) = 2

- Logarithmic Equality: a^{log_x b} = b^{log_x a} | AzuCATion

- Login

- Logout

- Max p with p+q+r=5 & pq+qr+rp=3 (positives)

- MDI Behavioral Assessment Tests (BAT)

- Members

- Membership Account

- Multi‑Base System Calculator

- My account

- NST (National Scholarship Test) 2024 Registration Page – Fill The Form

- Number System Question Bank for CAT | Topic-Wise Practice with Solutions

- Our Blogs

- Password Reset

- Percentage, Profit, Loss & Discount Question Bank for CAT, XAT, and Other MBA Exams

- Perpendicular on Angle Bisector — Special Case

- Privacy Policy

- Profile

- Ratio: Sum of Odd Factors to Sum of Even Factors

- Reading Comprehension RC – Question Bank for CAT, XAT, and Other MBA Exams

- Refund Policy

- Register

- Reset Password

- Roots of x³ + 2x² − x + 3 – Evaluate (p²+4)(q²+4)(r²+4)

- SCRA 2012 — Find k from 3^49(x+iy) = (3/2 + i√3/2)^100

- Sequence and Series Question Bank for CAT | Topic-Wise Practice with Solutions

- Services

- Shop

- Simple and Compound Interest for CAT | Topic-Wise Practice with Solutions

- SSC CGL Coaching in Jharkhand

- Success Story

- Surds Question Bank for CAT | Topic-Wise Practice with Solutions

- Team

- Term Conditions

- Terms & Conditions

- The Outcome Sheet – Profile Mapping 2025

- Time Model – T = aL + bG (AMC-inspired)

- Total Number of Terms in Polynomial Products

- Triangle Centroid & Medians — Simple Guide

- Triangle Medians — 3 Killer Properties

- Triangle Medians — 3 Properties

- User

- User Account

- User Login

- User Register

- Wishlist

- Wishlist